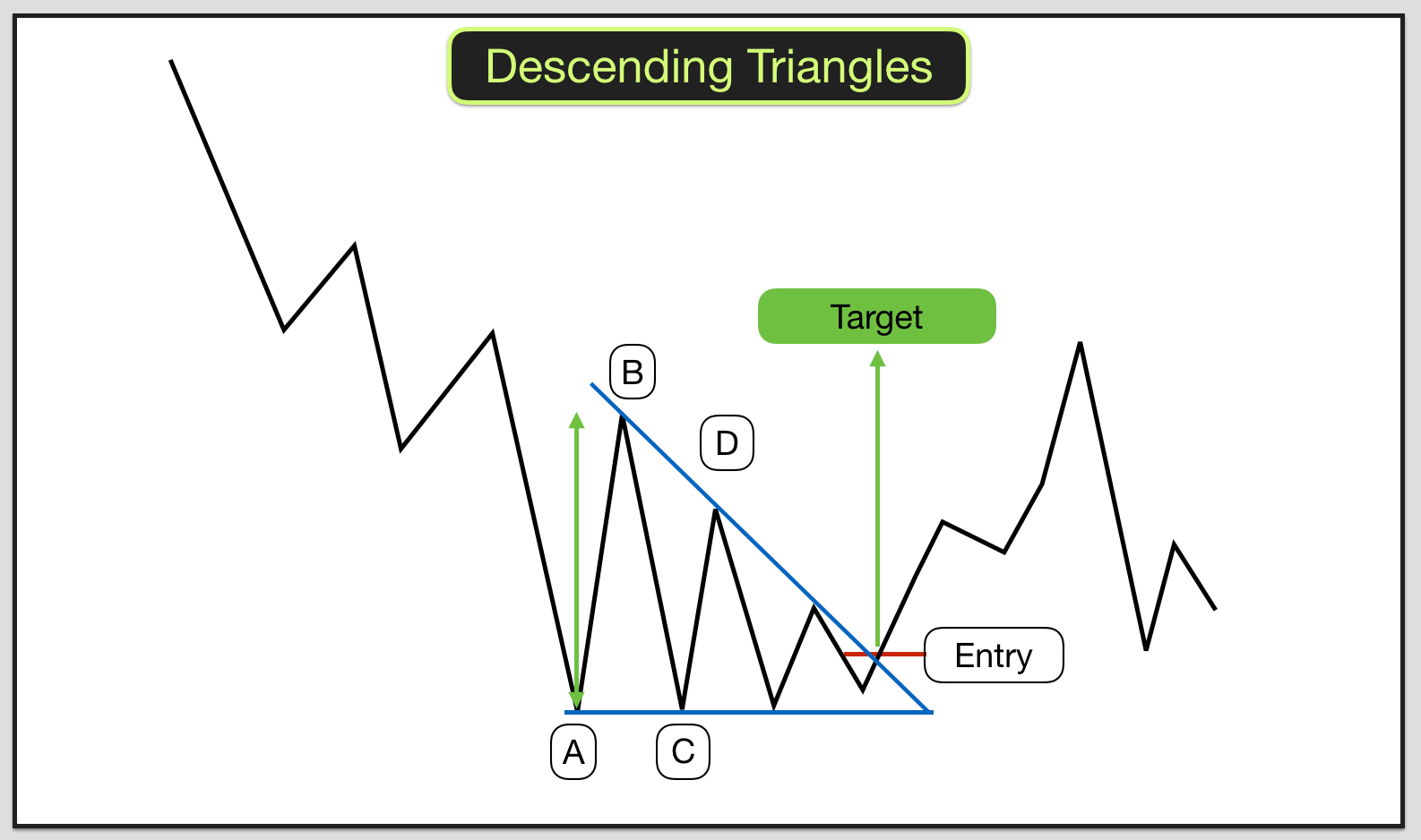

The second method is more conservative and less risky. In case the price action returns within a triangle, the pattern is invalidated, and the stop loss is triggered. Once the horizontal line is broken, the trade opens with a stop loss placed above the support – which now acts as resistance. The first method is more aggressive and places an entry point just below the support. In both cases, you will have to wait for the break of the support. There are two ways you can trade a descending triangle chart pattern. In this case, traders typically sell the security short and place a stop-loss slightly above the highest price reached during the formation phase. When this occurs, it serves as a confirmation that prices are likely to continue declining. However, the move up is weaker after each bounce, with bears eventually gaining enough strength to push the price through the support level. The pattern takes shape when a security’s price drops and bounces off the support level back up. In the case of a descending triangle, the top resistance trendline is downward-sloped, while the support trendline is flat.Īs opposed to an ascending triangle, a descending triangle forms during an overall downtrend. It suggests that the security’s price will continue trending downward as the pattern takes its final shape. As noted above, the upper trendline connects the highs, while the lower trendline links the lows.Īs its name suggests, a descending triangle is a bearish signal.

The names of these patterns suit their shapes as their upper and lower trend lines connect at the apex on the right side to form a corner. The three most common triangle patterns include descending, ascending, and symmetrical triangles. Once that happens, traders will attempt to confirm the pattern through a continued downward movement and enter short positions to help drive the price even lower. Ultimately, the price gains enough bearish momentum and breaks below the support. Meanwhile, the lower trendline serves as a support level, with prices frequently approaching this area and bouncing off it. This trend line indicates that sellers are driving the price down, suggesting that bearish sentiment is gaining momentum. During consolidation, a downward-inclined trend line can be drawn to connect the lower highs. Once bears take over, the descending triangle takes place as the market consolidates. This is critical since traders should avoid trading the pattern whenever it emerges.

#Trading descending wedge series

A descending triangle can be drawn by plotting one trend line that connects a number of lower highs and another horizontal trend line that links a series of lows at a horizontal level.įor a descending triangle to appear, the market must be in a downtrend.

0 kommentar(er)

0 kommentar(er)